Investigators with the Louisiana Department of Revenue (LDR) say the three women, working for Global Tax Service, charged clients as much as $110 to prepare and submit the sales tax refund form using false information and inflating the value of the losses. Starr Carbo, Johnnie Mae Ricard and Erica Williams, all of Westwego, are charged in connection with fraudulently preparing and submitting Natural Disaster Claim for Refund of State Sales Taxes Paid forms following Hurricane Ida in 2021. Millions in state tax refunds heading to Unclaimed Property if taxpayers don’t claim them.Continue ReadingīATON ROUGE – Three Louisiana residents face felony charges after allegedly defrauding a state program that offers sales tax refunds on personal property destroyed in a natural disaster.īased on a Presidential declaration, citizens can apply for a refund of sales tax they paid on items lost during a declared disaster. 6 deadline.Īny refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. If you received one of the letters but haven’t responded yet, simply complete and return the attached voucher to LDR. The remaining approximately $9.5 million in funds will be transferred by law to the Unclaimed Property Division of the state treasurer’s office later this month if not claimed by Oct. So far, approximately 4,000 have responded to claim their refunds. In August, LDR sent Notice of Unclaimed Property letters to 20,400 individual and business taxpayers. 6 to claim millions of dollars in state income tax refunds before the Louisiana Department of Revenue (LDR) transfers them to the state’s Unclaimed Property fund. Schedule G is used to report income from the rental of personal property.BATON ROUGE – Thousands of Louisiana taxpayers have until Thursday, Oct.Schedule F is used to report a taxpayer's profit, loss, or deduction from a farming operation.Schedule E is used to report interest and dividend income.

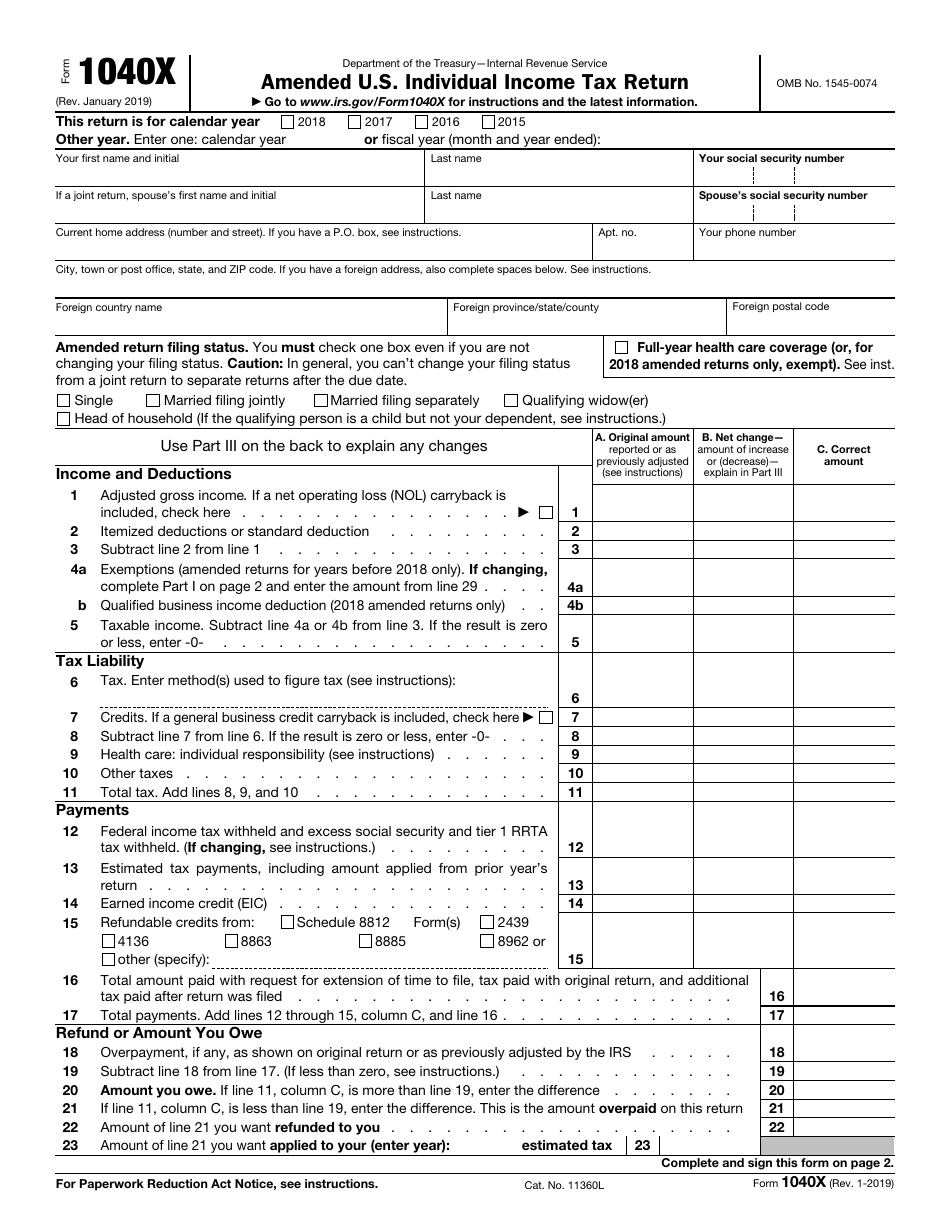

#Irs 1040 form pdf

The attachments that can be filed along with Form 1040 pdf are as follows: The general instructions for file Form 1040 fillable are provided in this website. The second page of the Form is for filing one's income inFormation. The first page of the Form is for filing one's personal inFormation. It is a two-page Form consisting of three sections, with additional attachments. Form 1040 tax instructions is user-friendly.

0 kommentar(er)

0 kommentar(er)